Irs Form 1041 Schedule G 2024 Calendar – The IRS Tax Refund Calendar 2024. This means that for those filing from January 23 to 28, potential refund dates include February 17 for direct deposit and February 24 for mailed checks. The . Taxpayers could have started filing their taxes for the 2023 tax year on Jan. 29.. You can use the schedule chart below to estimate when you can expect to receive your refund based on when you .

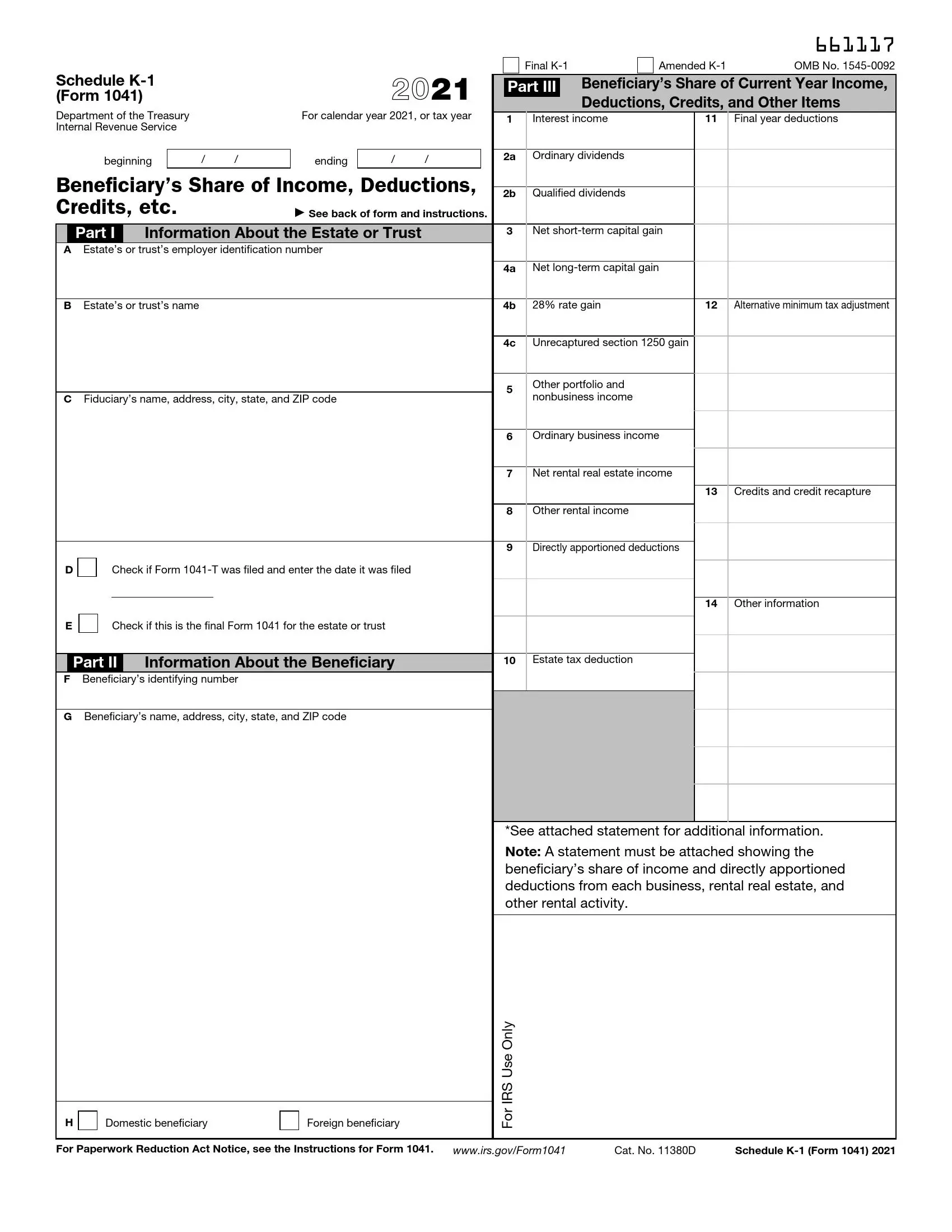

Irs Form 1041 Schedule G 2024 Calendar

Source : formspal.comSchedule D (Form 1041) 2023 Fill Online, Printable, Fillable

Source : form-1041-schedule-d.pdffiller.comVT Dept of Labor on X: “#1099 G tax forms have been mailed to

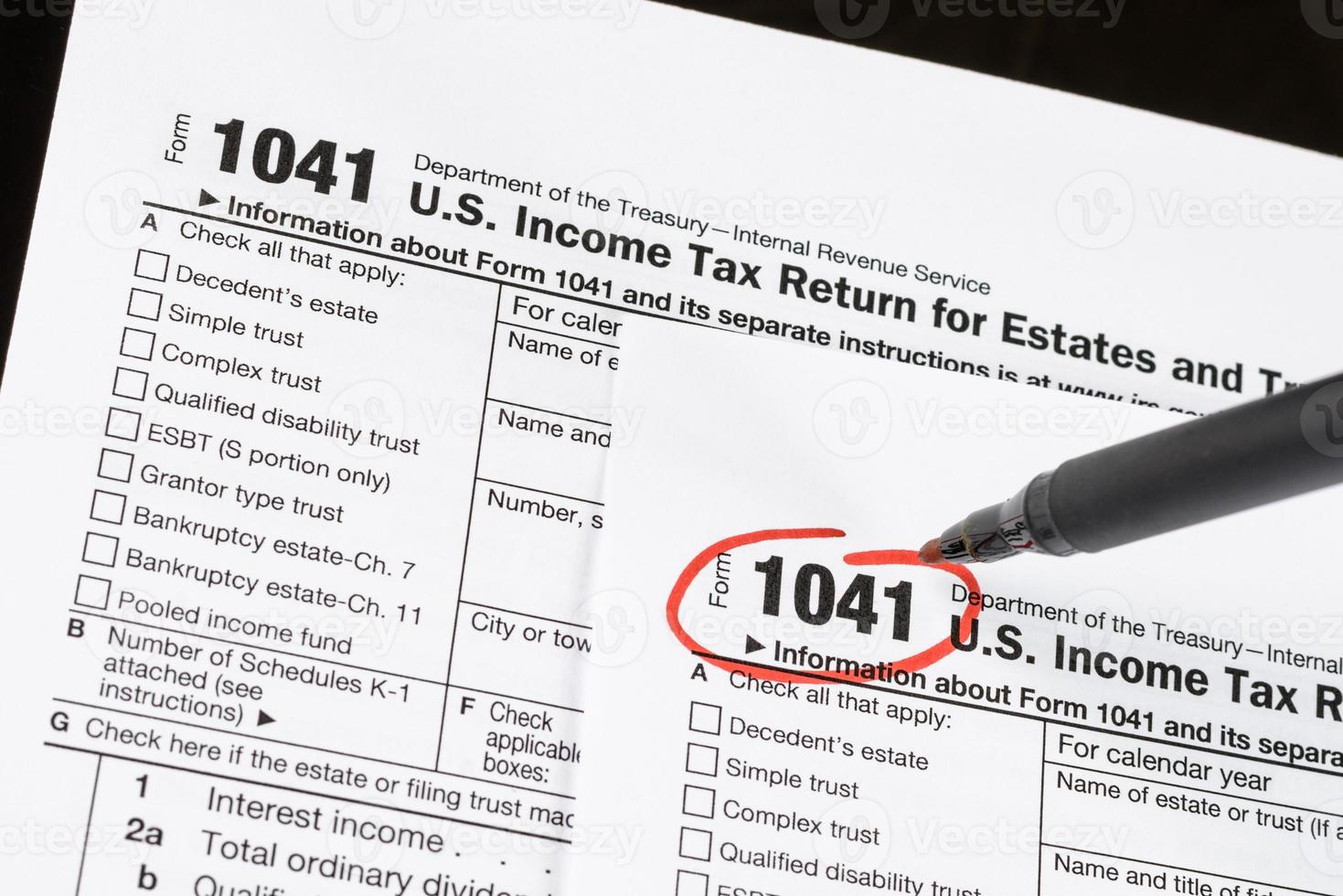

Source : twitter.com3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041

Source : www.irs.govForm 1041 U.S. Income Tax Return for Estates and Trusts. United

Source : www.vecteezy.com3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041

Source : www.irs.gov2024 tax calendar Miller Kaplan

Source : www.millerkaplan.com3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041

Source : www.irs.govCompleting a 1041 and an Introduction to Additional Business

Source : www.youtube.com3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041

Source : www.irs.govIrs Form 1041 Schedule G 2024 Calendar IRS Schedule K 1 Form 1041 ≡ Fill Out Printable PDF Forms Online: 2024. Late returns are accepted via e-file until November. “Understanding the estimated tax refund schedule, being aware of delays related to specific tax credits, and using efficient tax-filing . Keep your income records handy. Form 1095 may also required if you’re getting your coverage via health insurance marketplace. If the IRS issued you an Identity Protection Personal Identification .

]]>